- In the IPO 50% OFS is by Ant Financials.

- Remaining OFS is by Alibaba, Elevation Capital, SoftBank and other existing share holders.

- Client base of over 333 millions and over 21 millions registered merchants as on March 2021.

- India’s largest payment platform with one of the most valuable brand in India.

- The PayTM Valuations is around US$6.3 billion as per Kantar BrandZ India 2020 Report.

- Paytm raises ₹8235 crores from 122 Anchor Investors

- Paytm share price doubles to Rs 24,000 in grey market on IPO buzz; should you buy it ahead of IPO? – Financial Express (02 June 2021)

- Paytm shares go past ₹21,000 in grey market – Livemint (01 June 2021)

- Paytm’s Share Price Jumps in Grey Market After News of IPO Listing: Report – News18 (02 June 2021)

Paytm IPO Review

- Must Apply

Brokerage Firm IPO Reviews

- Axis Bank: Neutral

Paytm IPO Date & Price Band

| IPO Open: | 08 November 2021 |

| IPO Close: | 10 November 2021 |

| IPO Size: | Approx ₹18300 Crores |

| Fresh Issue: | Approx ₹8300 Crores |

| Offer for Sale: | Approx ₹10000 Crores |

| Face Value: | ₹1 Per Equity Share |

| Price Band: | ₹2080 to ₹2150 Per Equity Share |

| Listing on: | BSE & NSE |

| Retail Quota: | 10% |

| QIB Quota: | 75% |

| NII Quota: | 15% |

| DRHP Draft Prospectus: | Click Here |

| RHP Draft Prospectus: | Click Here |

Paytm AMC IPO Market Lot (Final)

| Minimum Lot Size: | Minimum 6 Shares for 1 lot |

| Minimum Amount: | ₹12,900 for 1 lot |

| Maximum Lot Size: | Maximum 90 Shares for 15 lot |

| Maximum Amount: | ₹193,500 for 15 lot |

Paytm IPO Date, Time Table, Allotment & Listing

| Price Band Announcement: | 27 October 2021 |

| Anchor Investors Allotment: | 03 November 2021 |

| IPO Open Date: | 08 November 2021 |

| IPO Close Date: | 10 November 2021 |

| Basis of Allotment: | 15 November 2021 |

| Refunds: | 16 November 2021 |

| Credit to Demat Account: | 17 November 2021 |

| IPO Listing Date: | 18 November 2021 |

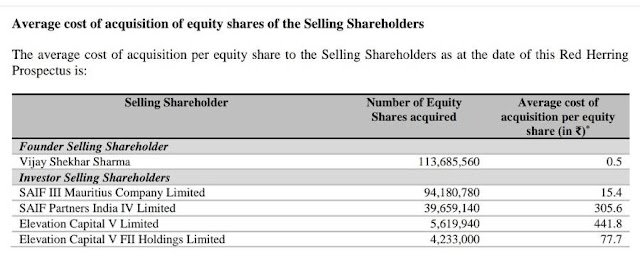

Paytm Share Cost of Acquisition as per RHP

Paytm IPO Form

How to apply the Paytm IPO? You can apply Paytm IPO via ASBA available in your bank account. Just go to the online bank login and apply via your bank account by selecting the Paytm IPO in the Invest section. The other option you can apply Paytm IPO via IPO forms download via NSE and BSE. Check out the Paytm forms – click NSE Forms & BSE Forms blank IPO forms download, fill and submit in your bank or with your broker.

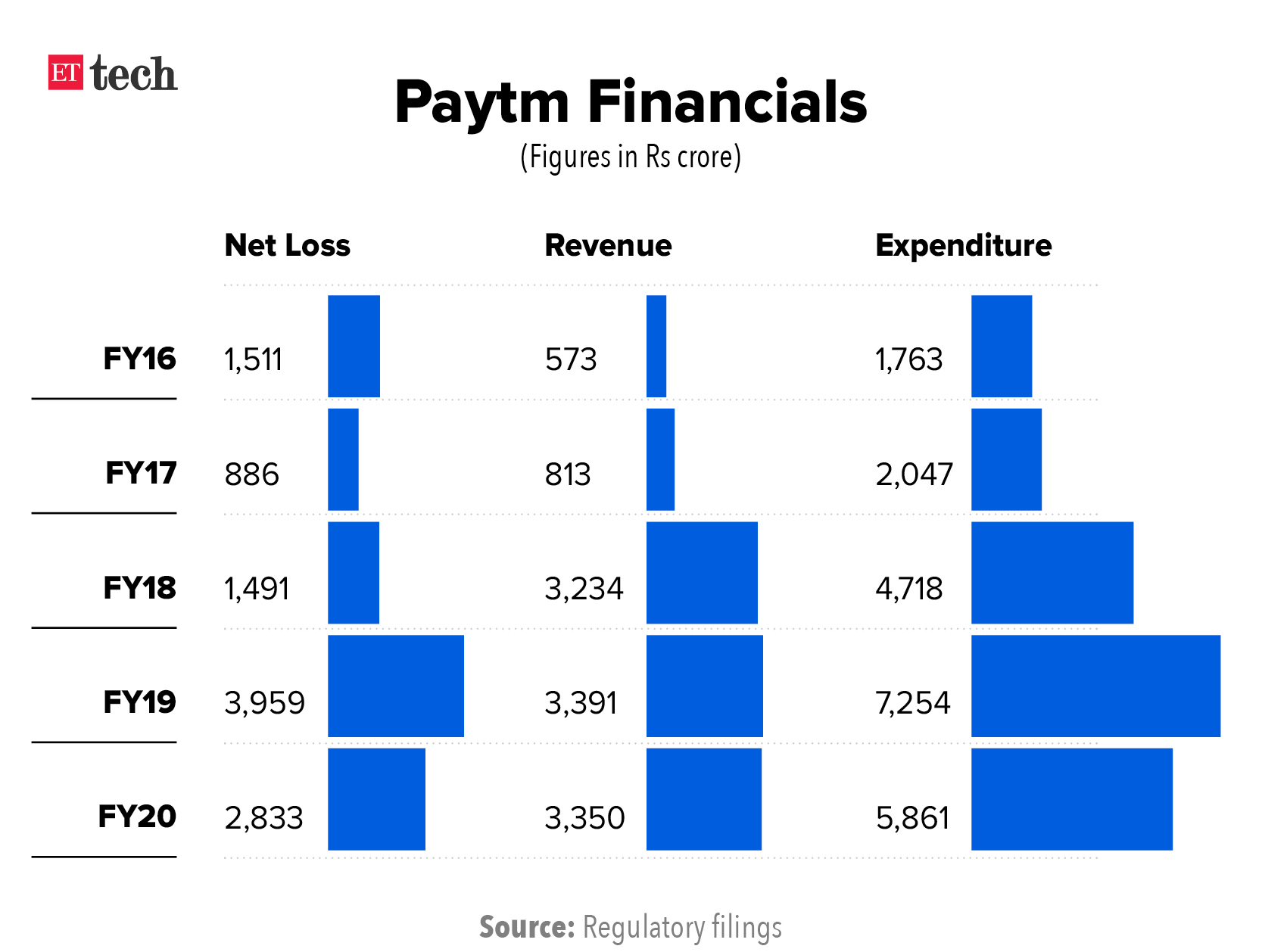

Paytm Company Financial Report

| ₹ in Crores | |||||

| Revenue | Expense | PAT |

|||

| 2019 | ₹3580 | ₹7744 | -₹4236 | ||

| 2020 | ₹3541 | ₹6138 | -₹2942 | ||

| 2021 |

₹3187 | ₹4783 | -₹1704 | ||

Company Promoters

- The company is a professionally managed company and does not have an identifiable promoter.

About Paytm

Vijay Shekhar Sharma, Founder & CEO of Paytm and One97 Communications Limited together own Paytm Payments Bank, country’s largest digital bank with over 58 million account holders. Working on its mission to bring un-served & under-served Indians under the formal banking system, it has made banking accessible & convenient to people across the country through innovative use of technology.

It’s wholly-owned subsidiary ‘Paytm Money’ has achieved the distinction of becoming India’s biggest investment platform within its first year, and is now one of the largest contributors of new Systematic Investment Plans (SIPs) to the Mutual Funds industry; it has already received approvals to launch Stock Broking, Demat Services and National Pension System (NPS) services, and strives to continue to broaden the financial services and wealth management opportunities to the unbanked and underserved Indians.

Paytm First Games, which is another group company (a joint venture between One97 Communications Ltd and AG Tech Holdings), has quickly become India’s go-to gaming and stay-at-home entertainment option for millions of users across the country. The platform caters to all types of gamers with an exhaustive array of games for amateurs as well as esports for gaming pros.

Paytm Insurance is a wholly-owned subsidiary of One97 Communications Ltd (OCL) and has secured a brokerage license from IRDAI. It offers insurance products to millions of Indian consumers across four categories including two-wheeler, four-wheeler, health and life. The company aims to simplify insurance and create a seamless, easy to understand online journey for its customers.

Paytm IPO Registrar

Link Intime India Private Limited

C-101, 247 Park, L.B.S. Marg, Vikhroli (West) Mumbai

400 083, Maharashtra

Tel: +91 022 4918 6200

E-mail: [email protected]

Investor Grievance E- mail:

[email protected]

Website: www.linkintime.co.in

Contact Person: Shanti Gopalkrishnan

SEBI Registration No.: INR00000405

Paytm IPO Lead Managers

- Morgan Stanley India Company Private Limited

- Goldman Sachs (India) Securities Private Limited

- Axis Capital Limited

- ICICI Securities Limited

- J.P. Morgan India Private Limited

- Citigroup Global Markets India Private Limited

- HDFC Bank Limited

Company Address

ONE 97 COMMUNICATIONS LIMITED

Registered Office:

First Floor, Devika Tower,

Nehru Place, New Delhi 110 019

Tel: +91 11 2628 0280

Website: www.Paytm.com

Corporate Office:

B-121, Sector 5, Noida

Uttar Pradesh 201 301

Contact Person: Mr. Amit Khera

Company Secretary and Compliance Officer

Tel: +91 120 4770770

E-mail: [email protected]

Paytm IPO FAQs

What is Paytm IPO?

When Paytm IPO will open?

What is Paytm IPO Investors Portion?

How to Apply the Paytm IPO?

How to Apply the Paytm IPO through Zerodha?

How to Apply the Paytm IPO through Upstox?

What is Paytm IPO Size?

What is Paytm IPO Price Band?

What is Paytm IPO Minimum and Maximum Lot Size?

What is Paytm IPO Allotment Date?

What is Paytm IPO Listing Date?

Note: The Paytm IPO details officially announced. The IPO grey market premium (Paytm IPO Premium) is added on the IPO grey market page.