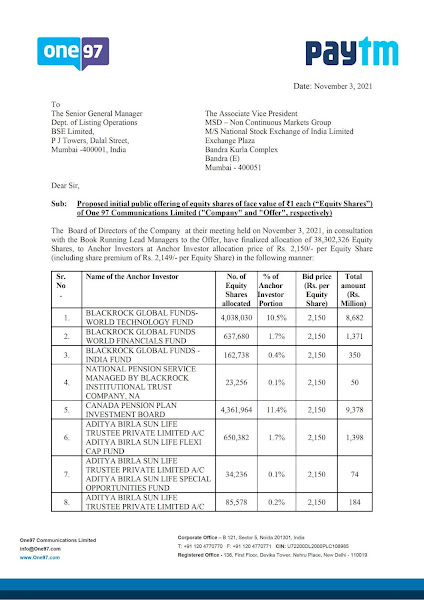

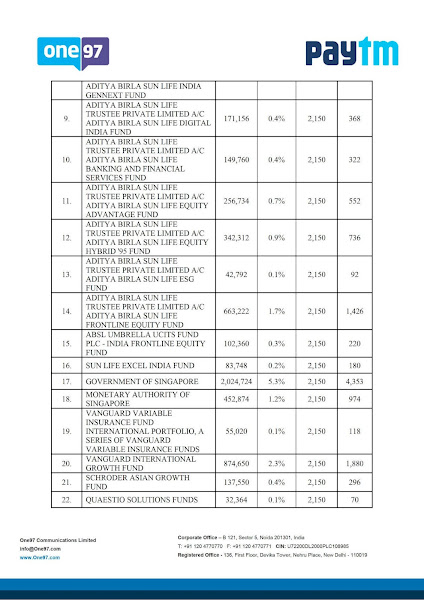

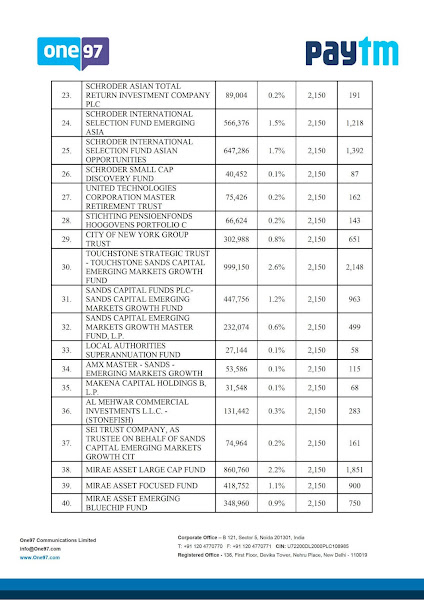

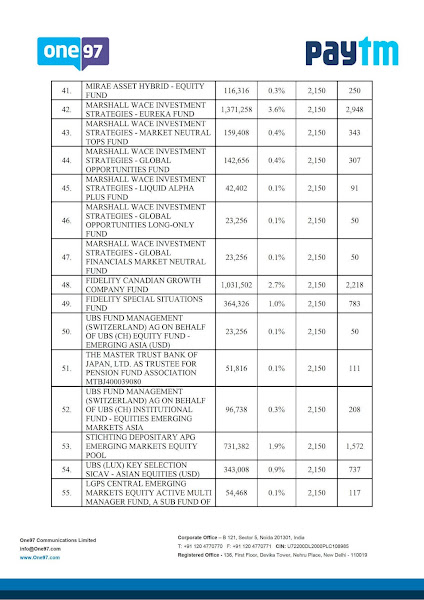

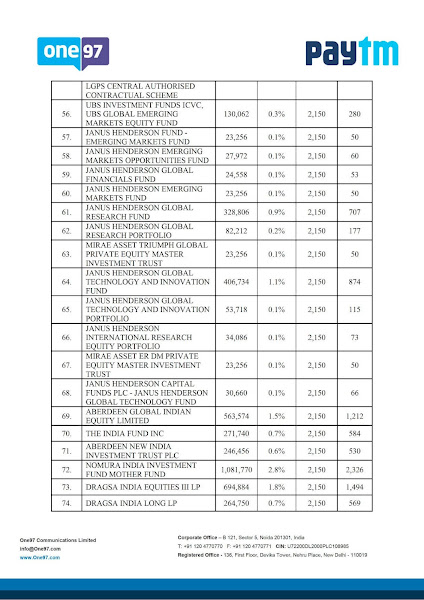

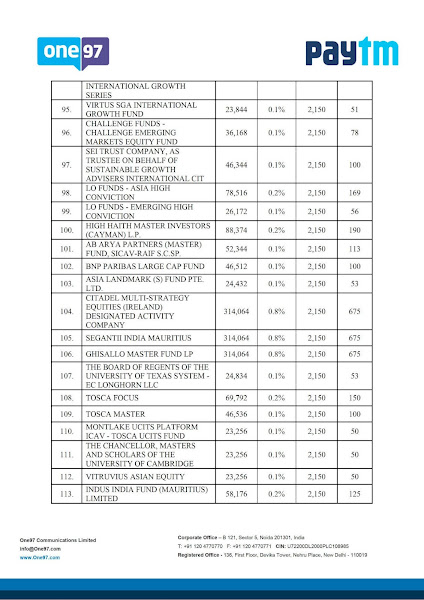

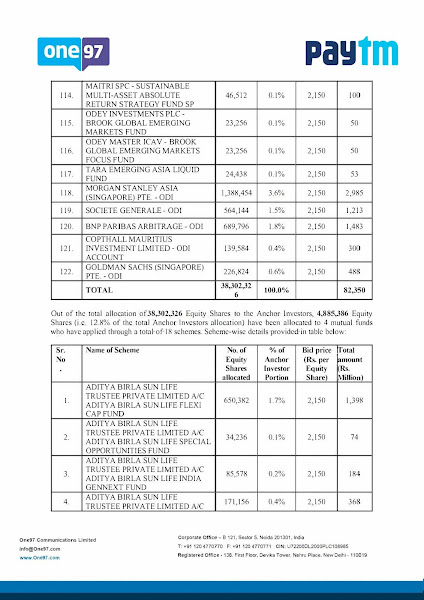

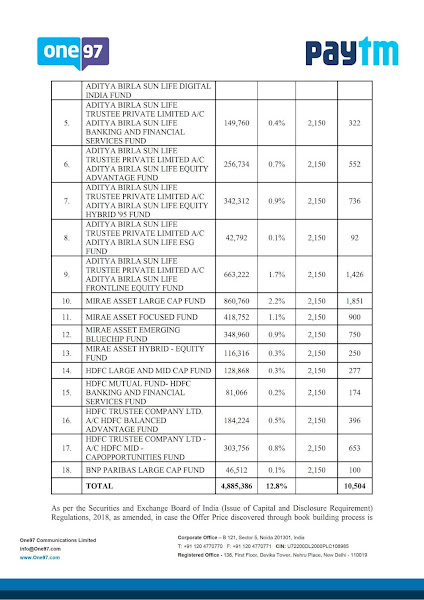

A leading digital payments brand Paytm’s parent company One97 Communications Private Limited raised ₹8235 crore from anchor investors on November 03, 2021 Wednesday before the IPO. The Paytm IPO to open on November 08, Monday. The company allotted total of 38,302,326 equity shares to 122 Anchor investors at a upper price band ₹2150. The anchor investors list includes 4 Mutual Funds through a total of 18 schemes. The company is going to raise ₹18300 crores via IPO. Check out the final list of Paytm Anchor Investors given below:

List of Paytm Anchor Investors:

The Board of Directors of the Company at their meeting held on November 3, 2021, in consulation with the Book Running Lead Managers to the Offer, have finalized allocation of 38,302,326 Equity Shares, to Ahcor Investors at Anchor Investor allocation price of ₹2,150 per Equity Share (including share premium of ₹2,149 per equity share). The details are given below: