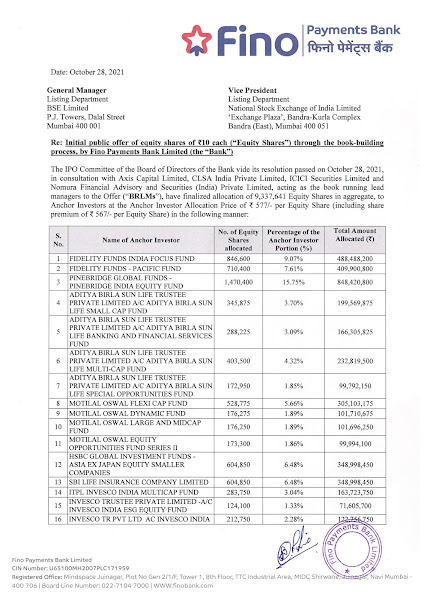

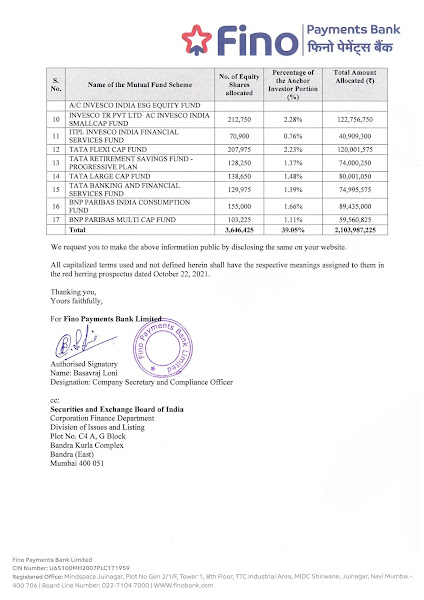

A Maharashtra based FinTech company Fino Payments Bank raised ₹539 crore from anchor investors on October 28, 2021 Thursday before the IPO. The Fino Payments Bank IPO to open on Friday, October 29. The company allotted total of 93,37,641 equity shares to 29 anchor investors at a upper price band ₹577. The anchor investors list includes 5 Mutual Funds through a total of 17 schemes. The company is going to raise ₹1200 crores via IPO. Check out the final list of Fino Payments Bank Anchor Investors given below:

List of Fino Payments Bank Anchor Investors:

The IPO Committee of the Board of the Directors of the Bank vide its resolution on October 28, 2021, in consultation with Axis Capital Limited, CLSA India Private Limited, ICICI Securities Limited and Nomura Financial Advisory And Securities (India) Pvt Ltd, acting as the book running lead managers to the offers (“BRLMs”). have finalized allocation of 93,37,641 Equity Shares in aggregate, to Anchor Investors at the Anchor Investor Allocation Price of ₹577 per Equity Share (including share premium of ₹567 per Equity Share). The details are given below: