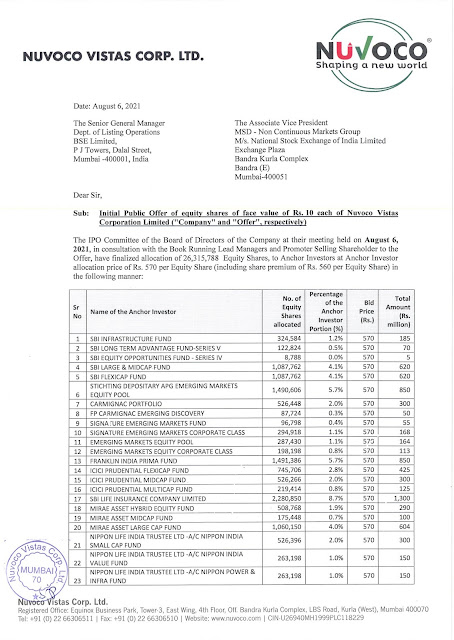

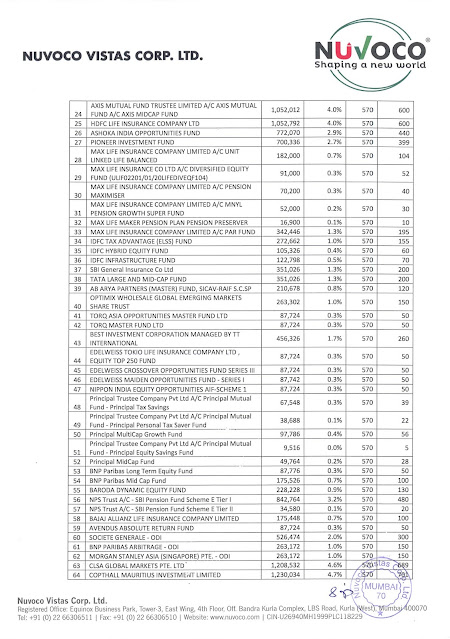

A Nirma Group Company Nuvoco Vistas raised ₹1500 crore from anchor investors on August 06, 2021 Friday before the IPO. The Nuvoco Vistas IPO to open on Monday with CarTrade IPO. The company allotted total of 26,315,788 equity shares to 66 anchor investors at a upper price band ₹570. The anchor investors list includes 12 Mutual Funds that holds around 42% of the share in anchor investment in Nuvoco Vistas. The company is going to raise ₹5000 crores via IPO that comprises ₹1500 crores fresh issue and ₹3500 crore offer for share. Check out the final list of Nuvoco Vistas Anchor Investors given below:

List of Nuvoco Vistas Anchor Investors:

The IPO Committee of the Board of the Directors of the Company at their meeting held on August 6, 2021, in consultation with the Book Running Lead Managers and Promoter Selling Shareholder to the Offer. have finalized allocation of 26,315,788 Equity Shares, to Anchor Investors at Anchor Investor allocation price of ₹570 per Equity Share (including share premium of ₹560 per Equity Share). Out of total 26,315,788 equity shares to the anchor investors, 11,158,048 equity shares (42.4%) have been allocated to 12 mutual funds who applied through a total 29 schemes. The details are given below: