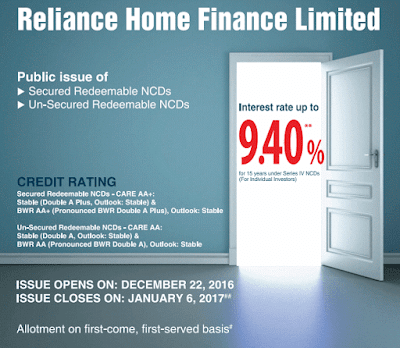

Reliance Home Finance NCD Issue Details:

– NCD Issue Open: 22 December 2016

– NCD Issue Close: 7 January 2017

– NCD Issue Size: Rs.3500 Crore

– Price Band: Rs.1000 Each

– Interest Rate: Upto 9.40% ** (Annually)

– Minimum Investment: 10 Bonds (Rs 10,000)

– Maximum Investment: 1000 Bonds (Rs 10 Lakhs) (Retailers)

Reliance Home Finance NCD Issue Rating:

– Secured: CARE AA+;Stable by CARE; BWR AA+ by Brickwork

– Un-secured: CARE AA; by CARE; BWR AA by Brickwork

Reliance Home Finance NCD Issue Listing:

– NCD Bonds will be listed on BSE and NSE. It will entail capital gains tax on exit through secondary market.

Reliance Home Finance NCD Issue Allotment:

– First Come First Serve

Reliance Home Finance NCD Issue Tenure:

– Category I: Institutional Investors – 3 Years

– Category II: Corporates – 5 Years

– Category III: HNIs – 10 Years

– Category IV: Retail Investors – 15 Years

Reliance Home Finance NCD Issue Categories:

– Category I: Institutional Investors – 30% reserved

– Category II: Corporates – 10% reserved

– Category III: HNIs – 30% reserved

– Category IV: Retail Investors – 30% reserved

Note: However NRIs cannot apply for this NCD.

Reliance Home Finance NCD Lead Manager:

– A.K. Capital Services Limited

– Axis Bank Limited

– Edelweiss Capital Limited

NCD Registrar:

Karvy Computershare Private Limited

Phone: +91-40-23312454

Fax: +91-40-23311968

Website: http://karisma.karvy.com

Company Information:

Reliance Home Finance Ltd

Reliance Centre, 6th Floor, Off Western Express Highway,

Santacruz East, Mumbai

Phone: 1800 210 3030

Email: [email protected]

Reliance Home Finance NCD Investment:

– The first 3 categories are secured it means the above debt is backed by assets of the company. The Reliance Home Finance NCD interest rate is higher around 2% compare to Bank FDs which is 9.40% compare to 7.50%. This NCD will give you more returns if you want to hold for long term. There will be less returns on listing day. So, keep invested in Reliance Home Finance NCD for long term basis.

How to Apply Reliance Home Finance NCD?

– One can apply online by ASBA. Its easy way to apply as per facility provided by banks. If you do not want to apply via ASBA download from from company website given below or collection centers and submit your application.

Subscribe if you want to go long in NCDs. Its a good 9.40% return on your investment.