Mutual funds are the ultimate solution for a small investor. A small investor used to face various problems before the introduction of mutual funds. These were:

1. LIMITED FUNDS – Small investors had to face the problems of investing in the big companies .They used to have limited fund with them which disabled them to invest in blue chip companies.

2. LACK OF EXPERT ADVICE –

Expert advice used to be out of their reach due to affordability problem.3. HIGH BROKERAGE RATES – Small investors had to purchase shares through brokers who used to charge high brokerage and there were lot more fraudulent activities to misguide small investors.

4. TIME LAG – This was another problem in receipt of shares There used to be delay in getting the shares

5. LIMITED ACCESS TO INFORMATION – They used to face problem in receiving information regarding the shares and Companies

6. PROBLEM REGARDING ALLOTMENT OF SHARES – They used to face this problem in case of big companies because big companies normally used to allot on pro rata basis.

7. COMMISSION AND BROKERAGES – High rate of commission and brokerages had to be borne by them.

WHAT ARE MUTUAL FUNDS?

“A mutual fund is a collective investment vehicle formed with the specific objective of raising money from a large number of individuals and investing it according to a pre-specified objective, with the benefits accrued to be shared among the investors on a pro-rata basis in proportion to their investment.”

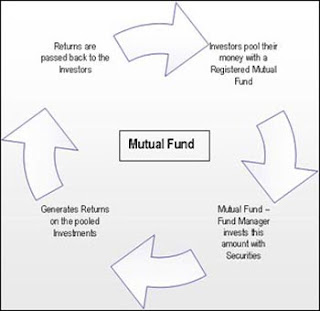

A Mutual Fund is a trust that pools the savings of a number of investors who share a common financial goal. The money thus collected is then invested in capital market instruments such as shares, debentures and other securities. The income earned through these investments and the capital appreciation realized are shared by its unit holders in proportion to the number of units owned by them. Thus a Mutual Fund is the most suitable investment for the common man as it offers an opportunity to invest in a diversified, professionally managed basket of securities at a relatively low cost. The flow chart below describes broadly the working of a mutual fund:

Advantages of Investing in Mutual Funds:

Advantages of Investing in Mutual Funds:1. Professional Management – The primary advantage of funds (at least theoretically) is the professional management of your money. Investors purchase funds because they do not have the time or the expertise to manage their own portfolio. A mutual fund is a relatively inexpensive way for a small investor to get a full-time manager to make and monitor investments.

2. Diversification – Mutual Funds invest in a well-diversified portfolio of securities which enables investor to hold a diversified investment portfolio (whether the amount of investment is big or small). Diversification reduces risk contained in a portfolio by spreading it. It is about not putting all your eggs in one basket. As mutual funds have huge corpuses to invest in, one can be part of a large and well-diversified portfolio with very little investment. 3. Better yields- Mutual fund buy and sell large amounts of securities at a time, thus help to reducing transaction costs, and help to bring down the average cost of the unit for their investors. So the profit passes on to the investor.

4. Liquidity – Investors can get mutual fund liquidated as and when they want. In open-ended schemes, they can get your money back promptly at net asset value related prices from the mutual fund itself.

5. Simplicity – Investments in mutual fund is considered to be easy, compared to other available instruments in the market, and the minimum investment is small. Most AMC also have automatic purchase plans whereby as little as Rs. 2000, where SIP start with just Rs.50 per month basis.

6. Low Cost – The cost of investing can reduce significantly for an investor. Instead of investing say Rs 2,000 each in 5 schemes i.e. Rs 10,000 totally; the investor can invest the desired amount in one scheme. Fund of funds provides the investor an opportunity to be invested in all the schemes at a fraction of the original cost .

7. Convenience – Convenience is another area where Fund of funds score heavily. The investor is spared the bother of tracking the performances of various schemes. Also he doesn’t have to churn his portfolio. E.g. if the equity markets hit a rough patch while the debt markets start looking up, the investor won’t have to reduce his holding in equity funds and invest in debt schemes. The fund manager will do the needful.

8. Flexibility – Another big advantage is that you can move your funds easily from one fund to another within a mutual fund family. This allows you to easily rebalance your portfolio to respond to significant fund management or economic changes.

9. Transparency – Regulations for mutual funds have made the industry very transparent. Investors can track the investments that have been made on their behalf and the specific investments made by the mutual fund scheme to see where their money is going. In addition to this, they get regular information on the value of their investment.

10. Tax benefit – Under section 80L of Income Tax Act ,the income of the investors is exempted from income tax. So this further helps the investors to have more savings

11. Less risk – The risk factor of the investor is reduced to a largest extent which could not have been possible in case of small investor. The risk in a diversified portfolio is lesser than investing in merely 2 or 3 securities. Mutual fund invests in larger companies .So the risk gets reduced.

12. Daily Pricing – Mutual funds must calculate the price of their shares every business day. Investors can sell (redeem) some or all of their shares anytime and receive the current share price, which may be more or less than the price originally paid. The share price, called net asset value, or NAV, is the market value of all the fund’s securities, minus expenses, divided by the total number of shares outstanding. The NAV changes as the values of the underlying securities rise or fall, and as the fund changes its portfolio by buying new securities or selling existing ones. Daily NAVs appear in the financial pages of most major newspapers.

13. Reduces Risk – As the money of small investor is invested into a portfolio i.e investment into many large companies. So it reduces the risk of the investor. It could not have been possible for him to invest in different large companies.

14. Automatic Reinvestment – Re investment of dividends and capital gains is possible in mutual funds schemes otherwise the money gets fritted away. It enthuses a habit of saving in long run for the investor.

15. Safety – Investors feel safe while investing in mutual funds as these are governed by SEBI guidelines, which act as watchdog for the investor for protecting them from fraudulent activities.

16. Other Advantages – Indian Mutual fund industry also presents several other benefits to the investor like: transparency – as funds have to make full disclosure of investments on a periodic basis, flexibility in terms of needs based choices, very well regulated by SEBI with very strict compliance requirements to investor friendly norms

Disadvantages of Investing Mutual Funds:

1. No Guarantees – No investment is risk free. If the entire stock market declines in value, the value of mutual fund shares will go down as well, no matter how balanced the portfolio.

2. Costs – The biggest source of AMC income , is generally from the entry & exit load which they charge from an investors, at the time of purchase. The mutual fund industries are thus charging extra cost under layers of jargon.

3. Dilution – Because funds have small holdings across different companies, high returns from a few investments often don’t make much difference on the overall return. Dilution is also the result of a successful fund getting too big. When money pours into funds that have had strong success, the manager often has trouble finding a good investment for all the new money.

4. Taxes – when making decisions about your money, fund managers don’t consider your personal tax situation. For example, when a fund manager sells a security, a capital-gain tax is triggered, which affects how profitable the individual is from the sale. It might have been more advantageous for the individual to defer the capital gains liability.

5. Misleading Advertisements – The misleading advertisements of different funds can guide investors wrongly. Some funds may be incorrectly labeled as growth funds, while others are classified as small caps or income funds.

A fund can therefore manipulate prospective investors by using names that are attractive and misleading. Instead of labeling itself a small cap, a fund may be sold as a “growth fund”. Or, the “Congo High-Tech Fund” could be sold with the title “International High-Tech Fund”.

6. Fluctuating-Returns – Mutual funds are like many other investments without a guaranteed return. There is always the possibility that the value of your mutual fund will depreciate. Unlike fixed-income products, such as bonds and Treasury bills, mutual funds experience price fluctuations along with the stocks that make up the fund. When deciding on a particular fund to buy, you need to research the risks involved – just because a professional manager is looking after the fund, that doesn’t mean the performance will be stellar.

CONCLUSION:

Despite the fact that there are limitations while investing in mutual Funds, they are still and would continue to be the unique financial tools, in any country. One has to appreciate the fact that every aspect of life has its periods of highs and lows. Mutual Funds have not failed in any country where they work within a regulatory framework. Their future is bright.

Source: blogs.siliconindia.com